When Politicians Attack: How the Candidates Plan to Wreck the Economy (and Your Wallet) — Option Plays for October 21, 2024

Put Selling Strategy

Discover what the candidates' economic policies could mean for your financial future and learn strategies to potentially generate a 22% annualized return while navigating the uncertainty ahead.

The Recap

Last month’s suggested put sales expired worthless, potentially generating up to 18% annualized returns, depending on the trades you selected. As of September, our model portfolio has generated nearly 15% year-to-date — which annualizes to just under 20%. Read on to see our ideas for this options cycle.

The Current

In this issue, let’s take a look at how the two U.S. Presidential candidates stack up with regards to the economy as they both have policy ideas that could hamper economic growth and wealth building.

The Economy

Before we can assess which candidate poses a greater threat to the economy, let’s first consider the current state of economic affairs:

GDP: The economy has shown consistent growth, with GDP continuing to rise steadily since the pandemic.

Inflation: Inflation has stabilized at 2.4%, which mirrors the levels seen in January 2020.

Unemployment: While unemployment has ticked up slightly by 0.3% over the last year, it remains manageable at 4.1%, a slight increase from the pre-pandemic low of 3.5%.

Stock Market: The stock market continues to hit record highs, with new records being broken almost weekly.

With the economy doing relatively well, let’s turn to the candidates. Which candidate is the greater danger to the economy?

The Candidates

On one side we have, a half-witted bloated gas bag who is morally and mentally degenerate. A pox on society. In another time, we would treat him with mercury and leeches, placing his head in a block so he would be unable to bite the other inmates of Bedlam. He's a man whose best days are long past, spent in bankruptcy, and who now struggles to string together two semi-coherent phrases while performing before crowds of feral NASCAR fans, hungry for his impending crash and blood in the streets.

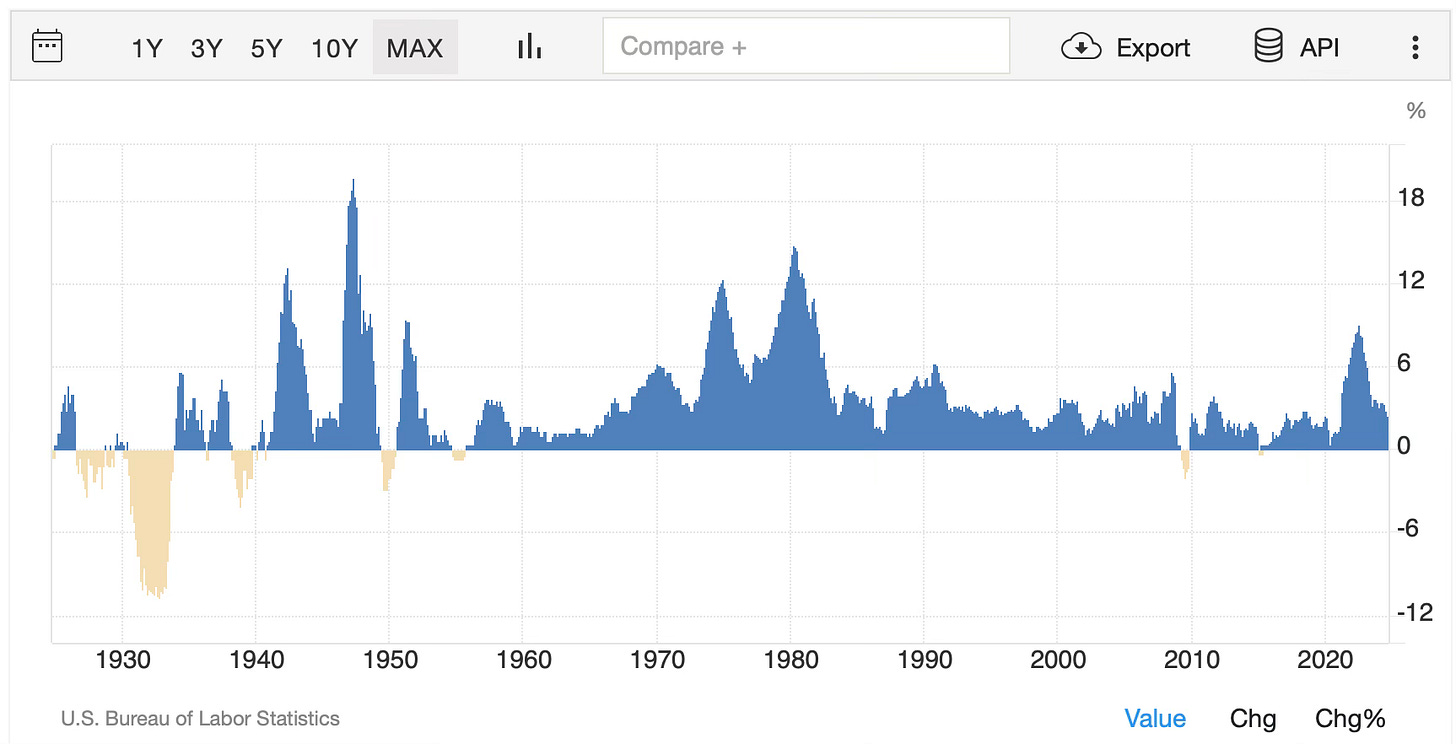

His understanding of economics seems rooted in a bygone time, where bad ideas are recycled as bold new strategies. Among his more reckless proposals: a plan to raise tariffs by 20% across the board, and as high as 60% on Chinese goods. If this sounds familiar, it should. These protectionist measures echo the Smoot-Hawley Tariff of 1930—an economic blunder that many believe worsened the Great Depression.

To quote the Tax Foundation:

"Many economic historians have cautioned that impressive growth in the late 1800s and early 1900s cannot be explained by high tariffs. Instead, labor force growth and capital accumulation — neither of which have strong links to tariffs — are responsible for America’s fast growth during this period. If anything, it is possible that the high protective tariffs of the late 19th century somewhat hindered America’s economic growth."

Commerical trade wars are unprofitable, inadvisable, and idiotic — and proof that old, feeble men suffering from early onset dementia have no concept of economics and are a threat to our societal and individual wealth, as well as our world-standing as a powerful economic engine of growth.

Then we have the other candidate, a bland bureaucrat promising stability and boredom. She’s a Chardonnay stepmom with a couple of nutty economic ideas, but nothing that would tank the economy and destroy the wealth of a nation — simply a continuation of economic policies we can plan for and profit from.

In an attempt to pander to the marginalized, she proposes a Nixonian effort at the price control of groceries. This will simply end poorly and ineffectively and be of no consequence. She should instead attack food production costs directly, for example, by eliminating protectionist sugar tariffs.

And further spurred on by the mouth-breathing progressives in her party — who are like vicious snot-nosed trick-or-treaters demanding candy — she has another plan to hand out $25K to first-time homebuyers for the purchase of a home. This policy is essentially welfare for homeowners, promising to increase property values across the country and locking out the younger, less fortunate generations from home ownership — proof that progressives have no concept of economics.

In short, both candidates seem ready to move away from the free-market principles that have vastly improved the well being, living standard, and health of literally billions of people around the world.

What Do the Experts Say?

The Wall Street Journal recently polled 66 economists. The majority think Trump's polices will be more likely to have negative effects on inflation, interest rates, and upward pressure on the Federal deficit.

From an economic perspective, the choice of candidates should be clear. We don’t need risky trade wars or destabilizing housing handouts. What we need is thoughtful, measured economic stewardship.

In conclusion, on a personal note—if you're making choices that impact the economy, make sure you're thinking long term. Because, let’s face it, we all have some skin in the game.

Also, just between us guys … if you can still see your dick, you should carefully consider your vote.

The Trades

Alright. Enough of that nonsense. Here is the only part of this newsletter that actually matters — the trade ideas I’m considering:

Sell-to-open TQQQ 11/15 59 Puts at $0.91 for an estimated 22.52% annualized.

Sell-to-open TNA 11/15 35 Puts at $0.48 for an estimated 20.02% annualized.

Sell-to-open QQQ 11/15 460 Puts at $2.40 for an estimated 5.95% annualized.

As always, I include the QQQ ideas for those who don’t have access to trading options on triple ETFs like the TNA or TQQQ.

“Each year, the Great Pumpkin rises out of the pumpkin patch he thinks is the most sincere.”

— Linus

What I Do in General

I typically employ a 50-50 mix of TNA and TQQQ put sales in a portion of my account and implement the Global Tactical Asset Allocation (GTAA) strategy in the remainder. You can choose the combination of put-selling, GTAA, and other portfolio strategies that works best for you.

Background

It's important to understand the nature of these ETFs in order to understand their behavior in the market.

TNA is a triple ETF that tracks the Russell 2000 index, meaning its daily movements are three times the magnitude of the Russell's daily changes. For instance, if the Russell 2000 goes up 1% in a day, TNA would experience a 3% increase. This “amplification” applies to both upward and downward market moves.

Similarly, TQQQ is a triple ETF that mirrors the NASDAQ 100 index, exhibiting comparable behavior to TNA. Its daily fluctuations are three times the NASDAQ 100's daily moves.

While TNA and TQQQ offer substantial potential returns, it's worth noting that some brokerages may not permit options trading on triple ETFs or may require a higher level of option trading authorization, due to their leveraged nature. Therefore, I include QQQ in my analysis.

QQQ is a “regular” ETF that tracks the NASDAQ 100 index without the triple leverage aspect. By incorporating QQQ, you can accommodate situations where options trading on triple ETFs is restricted or requires additional permissions.

For more information on our put-selling strategy, visit our strategy page.

Disclaimer

It's always important to conduct thorough research and analysis before engaging in any investment strategy. It's also important to know that trading options involves risks, and the profitability of a trade depends on various factors, including market conditions, individual circumstances, and the behavior of the underlying asset. While the outcome of these trades may have been favorable in the case illustrated in this newsletter, it's crucial to thoroughly understand the risks and potential rewards of options trading before engaging in such activities. Please refer to our full disclaimer and review the Characteristics and Risks of Standardized Options document.

Next Steps

Questions: If you have any specific questions or would like further information regarding options trading, please feel free to ask.

Share: If you have found this content useful, please share this post.

Subscribe: If you’re still in your trial period, don’t forget to subscribe, so you never miss our monthly trades!